What is a good cash to investment ratio?

Cash and cash equivalents can provide liquidity, portfolio stability and emergency funds. Cash equivalent vehicles include savings, checking and money market accounts, and short-term investments. A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio.

“Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says Mark Henry, founder and CEO at Alloy Wealth Management. “If you need to start smaller and work your way up to that goal, that's fine. The important part is that you actually start.”

Many experts recommend investing 10% to 20% of your income, but how much you can afford to invest depends on many factors.

The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to 100 minus your age. So if you're 40, you should hold 60% of your portfolio in stocks. Since life expectancy is growing, changing that rule to 110 minus your age or 120 minus your age may be more appropriate.

5: The 10, 5, 3 Rule You can expect to earn 10% annually from stocks, 5% from bonds, and 3% from cash. 6: The 3-6 Rule Put away at least 3-6 months worth of expenses and keep it in cash. This is your emergency fund.

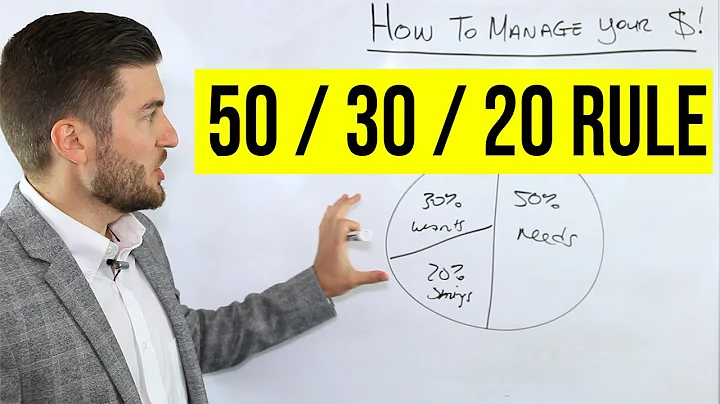

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

Having $20,000 in a savings account is a good starting point if you want to create a sizable emergency fund.

The most common way to use the 40-30-20-10 rule is to assign 40% of your income — after taxes — to necessities such as food and housing, 30% to discretionary spending, 20% to savings or paying off debt and 10% to charitable giving or meeting financial goals.

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

$3,000 X 12 months = $36,000 per year. $36,000 / 6% dividend yield = $600,000. On the other hand, if you're more risk-averse and prefer a portfolio yielding 2%, you'd need to invest $1.8 million to reach the $3,000 per month target: $3,000 X 12 months = $36,000 per year.

What is the 70% rule investing?

Basically, the rule says real estate investors should pay no more than 70% of a property's after-repair value (ARV) minus the cost of the repairs necessary to renovate the home. The ARV of a property is the amount a home could sell for after flippers renovate it.

Chief among them, of course, is Rule #1: “Don't lose money.” And most of all, beat the big investors at their own game by using the tools designed for them!

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

The 30-30-30-10 system allocates 30% of your money to housing, and another 30% goes for necessities. You devote 30% to financial goals and keep the remaining 10% for personal spending. This system's ease of use might make it appealing -- but it also doesn't leave much for fun spending.

In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

Consider an individual who takes home $5,000 a month. Applying the 50/30/20 rule would give them a monthly budget of: 50% for mandatory expenses = $2,500. 20% to savings and debt repayment = $1,000.

When your savings reaches $100,000, that's a milestone worth marking. In a world where 57% of Americans can't cover an unexpected $1,000 expense, having a six-figure savings account is commendable.

How much is too much cash in savings? An amount exceeding $250,000 could be considered too much cash to have in a savings account. That's because $250,000 is the limit for standard deposit insurance coverage per depositor, per FDIC-insured bank, per ownership category.

What is the Rule of 69? The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result.

What is the best savings breakdown?

This goes back to a popular budgeting rule that's referred to as the 50-30-20 strategy, which means you allocate 50% of your paycheck toward the things you need, 30% toward the things you want and 20% toward savings and investments.

One of the most common types of percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

Rural areas: In rural areas of developed countries, the cost of living is often lower than in urban areas. This means that $600 a month may be enough to cover rent and other expenses in a small town or rural area. Shared housing: Sharing a house or apartment with roommates can also help to lower housing costs.

As of 2023, the average salary in the USA varies largely across industries, job positions, age groups, levels of experience, and educational backgrounds. However, the average salary nationwide in the US, according to Forbes, is $59,428. On the other hand, median household income in the US was $70,784 in 2021.

It is just about possible for a single adult to pay for food and all bills (not rent) with £300 per month.